As your philanthropic interest grows, increasing your fund will allow you to build a lasting, thriving legacy and to accelerate your charitable gift planning. Increase your fund through the WorldSafe Institute at any time through a current or deferred (planned) gift.

Current Gifts

Appreciated Property (publicly traded stock, closely held stock, real estate),

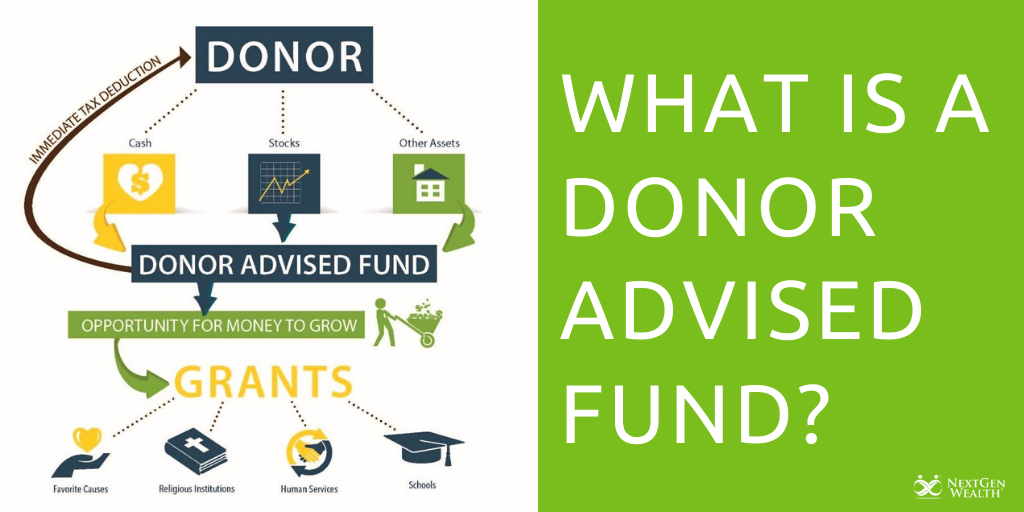

contributing stocks, bonds, mutual funds OR real estate from your assets may provide you with an income tax deduction based on the fair market value of the gift and eliminate all capital gains taxes. This would allow you to make a substantially greater gift than you otherwise would have thought possible for the same out-of-pocket cost.

Stock or Mutual Fund Transfer Instructions

DTC Transfer Instructions

Merrill Lynch / DTC #8862

For disseminating gifts, use our Wells Fargo account under the WorldSafe Institute. To make an investment, provide us with the name of stocks, approximate value of shares, anticipated date of transfer and broker’s contact information. Some mutual funds cannot be accepted on the Merrill Lynch platform. If you encounter this challenge, please reach out to your philanthropic officer for assistance.

Safe America can confirm receipt of inbound stock transfers one business day after the transferring agent executes the move through DTC. If you would like a confirmation of receipt when the shares are received, please reach out to your philanthropic officer.

Cash Wire Instructions

Bank: Wells Fargo, Marietta, GA 30062

ABA Routing Number: 061000104

Account: The WorldSafe Institute, Inc.

Account Number: 8800344106

Please identify name of donor and fund designation.

The WorldSafe Institute will inform Wells Fargo of pending transfers.

Before making this transfer, please notify your philanthropic officer at 770-509-7958.

By Check

Please make check out to: WorldSafe Institute

Memo line: “The ________________________ Fund”

Mail to: 2000 First Drive, Suite 310, Marietta, GA 30062, Attention: Accounting.

Matching Gifts

Since the WorldSafe Institute is a 501(c)-3 nonprofit organization, your contribution may be eligible for a matching gift from your company. Please see your company human resources representative for details.

Giving Instructions

Other Gifts

The WorldSafe Institute can devise a philanthropic plan that may include various gift assets, such as closely-held stock (private or restricted stock), qualified or non-qualified stock options, or family limited partnership interests. Please call your philanthropic officer for more information or to set up a complementary consultation with our gift-planning experts.

IRA Charitable Rollover

An IRA Charitable Rollover allows donors to direct up to $100,000 from their traditional IRA to charity tax-free. This option is open to donors age 70½ and older who have a traditional IRA, and it counts toward your Required Minimum Distribution, the amount a person over that age must withdraw each year. Traditional IRA funds are not subject to income tax when given directly to charity. IRA Charitable Rollover gifts may NOT be given to a donor-advised fund. You may give to other types of funds at the Institute or to our unrestricted funds.

Deferred Gifts (Planned Gifts)

Deferred or planned gifts allow you to make provisions for future philanthropy, while often providing tax advantages now or in the future. We strongly encourage you to meet with your professional advisor(s) prior to executing a planned gift. Deferred gift options at the WorldSafe Institute include:

Bequest

A bequest to the WorldSafe Institute is as simple as adding a codicil to your will. This is the most common planned gift and it may provide you with valuable estate tax savings. Bequests can be in the form of:

• A stated dollar amount or specific property,

• A percentage of the estate, or

• A portion or all of the remainder.

Your philanthropic advisor will be happy to work with your attorney or estate planner to draft appropriate language for your bequest.

Charitable Lead Trust

This trust allows you to provide income to your fund at the WorldSafe Institute for a fixed number of years. The remainder is then returned to you or to your named beneficiary, your heirs for example. Benefits may include the transfer of assets to others free of estate/gift taxes.

Charitable Remainder Trust

A Charitable Remainder Trust (CRT) allows you to establish a trust for the ultimate benefit of your fund at the WorldSafe Institute while retaining the income generated by the assets given. A CRT may help you eliminate capital gains taxes, reduce or eliminate estate taxes, improve lifetime cash flow, and, when coupled with an asset replacement trust, may provide for heirs as well.

You can also visit us in our Atlanta WorldSafe Institute office at 315 Boulevard, Suite 428, Atlanta, GA 30312, 770-973-7233 | worldsafeinstitute.org (11/12/22)

Life Estate

If you own valuable property that you would like to use during your lifetime but make arrangements to give it to the WorldSafe Institute upon death, you may receive a current income tax deduction and future estate tax deduction.

Life Insurance

One of the simplest ways to make a significant contribution is to give a life insurance policy to the WorldSafe Institute. You may give a policy that is no longer needed, take out a new policy or name the WorldSafe Institute as a beneficiary of an existing policy. A gift of life insurance may provide valuable income and estate tax savings.

Retirement Accounts (IRAs and retirement plans)

Qualified retirement plan accounts may be subjected to layers of taxation (i.e., estate tax, federal income tax and state income tax).

For some accounts, the combination of these taxes can be as high as 75-85 percent. A charitable gift of these funds, however, may provide your fund with the full 100 cents on the dollar. The 15-25 percent your heirs would have received may be replaced with an asset replacement trust. Numerous innovative retirement planned giving opportunities exist, and we would be happy to provide additional information upon request.

Our Atlanta location is at: 315 Boulevard, Suite 428, Atlanta, GA 30312

Call us at: 770-973-7233

(updated 11/12/22)